Curious about Regions Business Account? Yes, it’s a smart choice for your business banking needs. Managing finances is now a breeze with Regions Business Account. Stay ahead of the game, enjoy seamless transactions, and superior support. Let’s dive in and explore the benefits of Regions Business Account. Ready to elevate your business banking experience? Let’s get started.

Exploring the Regions Business Account

For businesses of all sizes, managing finances is a crucial aspect of operations. The Regions Business Account offers a comprehensive suite of features tailored to meet the specific needs of businesses, providing convenience, security, and flexibility. Let’s delve into the various aspects of the Regions Business Account to understand how it can benefit your business.

The Basics of Regions Business Account

The Regions Business Account serves as a centralized hub for all financial transactions related to your business. Here are some key points to know about this account:

– Designed for businesses: This account is specifically created to cater to the financial needs of businesses, offering essential features to facilitate transactions, manage cash flow, and more.

– Various account options: Regions offers different types of business accounts to suit varying business requirements. Whether you are a small startup or a large corporation, there is an account option that aligns with your needs.

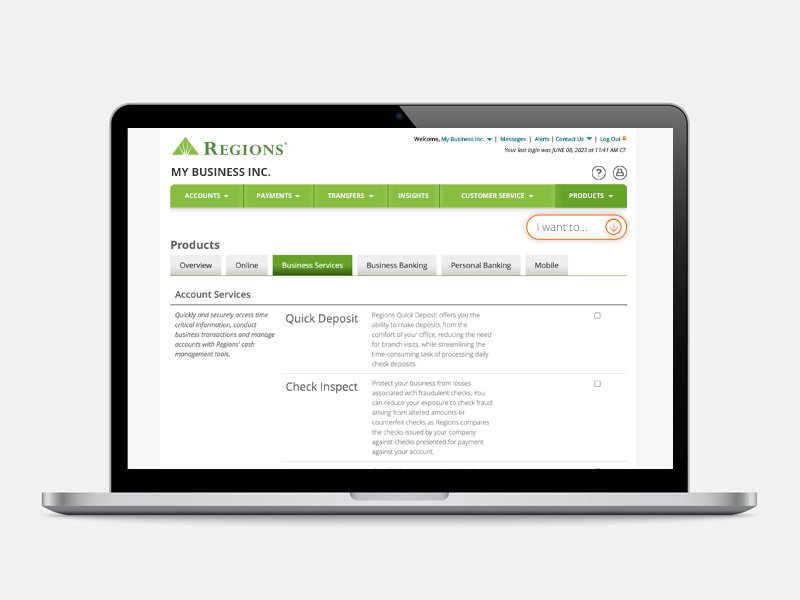

– Online and mobile banking: The Regions Business Account provides convenient online and mobile banking services, allowing you to access your account, make transactions, and manage finances anytime, anywhere.

Key Features of Regions Business Account

The Regions Business Account comes equipped with a range of features to simplify financial management for businesses. Let’s explore some of the key features that make this account stand out:

– **Cash Management Services**: Regions offers cash management services such as ACH payments, wire transfers, and positive pay to help businesses optimize cash flow and improve liquidity.

– **Merchant Services**: Businesses can benefit from merchant services provided by Regions, enabling them to accept various payment methods and streamline the checkout process for customers.

– **Fraud Prevention**: With advanced security measures and fraud prevention tools, the Regions Business Account helps safeguard your business against potential threats and unauthorized transactions.

Benefits of Regions Business Account

Choosing a Regions Business Account for your business can offer several advantages that contribute to your financial efficiency and overall success. Here are some benefits to consider:

– **Convenience**: The account’s online and mobile banking features make it easy to manage your finances on the go, saving you time and effort.

– **Customized Solutions**: Regions provides tailored solutions to address your specific business needs, ensuring that you have access to the tools and resources necessary for your operations.

– **Dedicated Support**: With Regions, you can expect excellent customer support and assistance for any account-related queries or issues, giving you peace of mind as you focus on growing your business.

Opening a Regions Business Account

If you are interested in opening a Regions Business Account for your business, the process is straightforward and simple. Here’s what you need to do to get started:

1. **Gather Required Documents**: Ensure you have all the necessary documentation, such as your business license, tax ID, and identification documents for authorized signers.

2. **Visit a Regions Branch**: Locate a nearby Regions branch and schedule an appointment to meet with a business banking representative who can guide you through the account opening process.

3. **Provide Information**: During the account opening process, you will need to provide details about your business, including its structure, operations, and expected banking needs.

Managing Your Regions Business Account

Once you have successfully opened a Regions Business Account, it is essential to actively manage and monitor your account to ensure smooth financial operations for your business. Here are some tips for effectively managing your account:

– **Regular Checking**: Make it a habit to regularly check your account balance, review transactions, and monitor account activity to detect any discrepancies or suspicious transactions.

– **Set Alerts**: Take advantage of the account alert features provided by Regions to stay informed about account activity, deposits, withdrawals, and more.

– **Utilize Online Tools**: Explore the various online tools and resources offered by Regions to track expenses, create budgets, and analyze financial data to make informed decisions for your business.

In conclusion, the Regions Business Account is a valuable financial tool designed to support businesses in managing their finances efficiently and securely. By leveraging the features and benefits of this account, businesses can streamline their financial operations, mitigate risks, and focus on achieving their growth objectives. Consider opening a Regions Business Account to take advantage of the tailored solutions and dedicated support that Regions has to offer.

🔥 Regions Business Account Review: Pros and Cons for Entrepreneurs

Frequently Asked Questions

What are the requirements to open a Regions business account?

To open a Regions business account, you will typically need to provide documentation such as your business tax ID, your personal identification, proof of address, and possibly additional information depending on the type of business entity.

Can I access my Regions business account online?

Yes, Regions provides online banking services for business accounts, which allows you to conveniently manage your account, view transactions, transfer funds, and more through their secure online portal.

How can I apply for a business loan through Regions?

To apply for a business loan with Regions, you can start by contacting a business banker at your nearest branch or applying online through their website. The process usually involves providing information about your business, financial statements, and the purpose of the loan.

What fees are associated with a Regions business account?

Fees for a Regions business account can vary depending on the type of account and services you choose. Common fees may include monthly maintenance fees, transaction fees, overdraft fees, and wire transfer fees. It’s advisable to review the fee schedule provided by Regions or consult with a representative for specific details.

Does Regions offer business credit cards?

Yes, Regions offers a variety of business credit card options tailored to meet the needs of different types of businesses. These credit cards may come with various rewards, benefits, and features designed to help manage business expenses efficiently.

How can I set up automatic payments for my Regions business account?

To set up automatic payments for your Regions business account, you can enroll in Regions Online Banking and set up recurring payments for bills or other expenses. This helps ensure that your payments are made on time each month without the need for manual intervention.

Final Thoughts

In conclusion, leveraging a Regions business account can provide essential tools and services for efficient financial management. Establishing a Regions business account offers seamless access to tailored solutions and personalized support. By utilizing a Regions business account, businesses can optimize their banking operations and enhance overall productivity. It’s crucial for businesses to consider opening a Regions business account to streamline their financial processes effectively.