Curious about the cause and effect within the business cycle? Let’s delve into what drives this intricate cycle of ups and downs. Understanding which elements influence the ebb and flow of the business world is key to navigating its complexities. The relationship between various factors – such as demand, supply, and economic policies – shapes the ever-evolving business landscape. So, which best describes the nature of cause and effect in the context of the business cycle? Let’s explore this dynamic interplay together, shedding light on the forces that drive the heart of commerce.

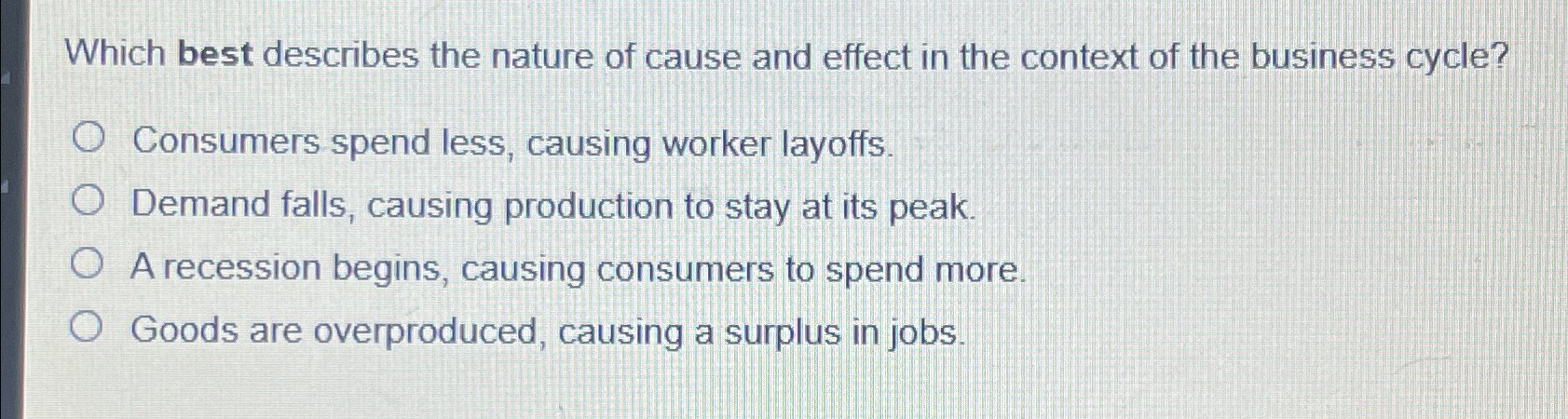

Which Best Describes the Nature of Cause and Effect in the Context of the Business Cycle?

The business cycle is a pattern of economic expansion and contraction that occurs repeatedly. Understanding the nature of cause and effect within the business cycle is essential for businesses, policymakers, and economists to make informed decisions. Let’s delve into the intricacies of how various factors contribute to the fluctuations in the business cycle.

Overview of the Business Cycle

The business cycle consists of four main phases:

1. Expansion

During this phase, the economy experiences growth in economic activity, characterized by increased production, employment, and consumer spending. Key indicators such as GDP, employment rates, and retail sales show positive trends.

2. Peak

The peak marks the highest point of the economic cycle, where growth rates start to slow down. Business investments may plateau, and inflation could begin to rise.

3. Contraction

Also known as a recession, this phase involves a decline in economic activity, leading to decreased production, rising unemployment, and lower consumer spending. GDP contracts, and businesses may cut back on investments.

4. Trough

The trough represents the lowest point of the cycle, where economic activity is at its weakest. However, it also sets the stage for potential recovery and the beginning of a new expansion phase.

Cause and Effect Relationships in the Business Cycle

The business cycle is influenced by a complex interplay of various factors, each contributing to the cyclical nature of the economy. Let’s examine some of the key cause-and-effect relationships within the business cycle:

1. Monetary Policy

Central banks use monetary policy tools, such as interest rates and money supply, to manage the money supply in the economy. The effects of monetary policy on the business cycle include:

- Lowering interest rates can stimulate borrowing and spending, leading to economic expansion.

- Raising interest rates can curb inflation but may also slow down economic growth.

- Changes in the money supply influence consumer and business confidence, impacting investment and spending decisions.

2. Fiscal Policy

Governments use fiscal policy, involving taxes and government spending, to influence economic activity. The cause-and-effect relationship between fiscal policy and the business cycle includes:

- Increased government spending during a recession can boost demand and stimulate economic growth.

- Tax cuts can leave more money in consumers’ pockets, leading to increased spending and investment.

- Austerity measures, such as spending cuts, can help control deficits but may also reduce overall demand and slow down economic recovery.

3. External Shocks

External factors, such as geopolitical events, natural disasters, or global economic conditions, can have significant impacts on the business cycle. The cause-and-effect dynamics of external shocks include:

- Oil price spikes can lead to higher production costs, affecting businesses and consumers alike.

- Trade disputes or tariffs can disrupt supply chains and impact international trade, influencing economic growth.

- Financial crises in other countries can spill over and affect global markets, triggering recessions or slowdowns.

Interconnectedness of Factors in the Business Cycle

It’s important to note that these factors do not operate in isolation but are interconnected within the business cycle. For example:

- Monetary policy decisions can affect consumer spending, business investments, and inflation rates simultaneously.

- External shocks can prompt governments to adjust fiscal policies to mitigate the impact on the economy.

By understanding the complex web of cause-and-effect relationships in the business cycle, stakeholders can better anticipate economic trends, plan strategically, and respond effectively to changing market conditions.

Anticipating and Mitigating Business Cycle Fluctuations

While the business cycle is a natural part of the economic landscape, businesses and policymakers can take proactive steps to anticipate and mitigate the impacts of fluctuations. Strategies include:

- Developing diversified product lines to weather changes in consumer demand during different phases of the cycle.

- Maintaining healthy cash reserves to navigate downturns and seize opportunities for growth during upswings.

- Adopting agile business models that can quickly adapt to changing market conditions and consumer preferences.

- Collaborating with policymakers and industry peers to advocate for supportive economic policies that promote stability and growth.

By being prepared and proactive, businesses can navigate the complexities of the business cycle more effectively and position themselves for long-term success.

Understanding the nature of cause and effect within the business cycle is crucial for businesses, policymakers, and economists to navigate economic uncertainties and capitalize on opportunities for growth. By recognizing the interconnectedness of various factors and the cyclical nature of the economy, stakeholders can make informed decisions that support long-term prosperity and resilience. With a nuanced understanding of these dynamics, stakeholders can proactively manage risks, seize opportunities, and contribute to a more stable and vibrant economic landscape.

If you have any further questions about the business cycle and its impacts, please refer to the FAQ section below.

Business Cycles: Boom and Bust

Frequently Asked Questions

### What are the primary causes of fluctuations in the business cycle?

The business cycle experiences fluctuations due to various factors such as shifts in consumer demand, changes in government policy, variations in interest rates, and global economic conditions.

### How does a recession impact the business cycle?

During a recession, there is a decrease in economic activity, leading to reduced consumer spending, lower business investments, rising unemployment rates, and decreased overall economic growth within the business cycle.

### What is the role of monetary policy in influencing the business cycle?

Monetary policy, implemented by central banks, can impact the business cycle by adjusting interest rates and money supply levels. Lowering interest rates can stimulate borrowing and spending, boosting economic activity, while raising rates can help control inflation during periods of rapid growth.

### How do external factors, such as international trade, impact the business cycle?

Changes in international trade, such as tariffs or global economic slowdowns, can influence the business cycle by affecting export/import levels, altering production costs, and impacting overall economic growth within the cycle.

Final Thoughts

In the business cycle, cause and effect are intricately linked. Economic events and policies lead to fluctuations in the cycle, impacting businesses and consumers directly. This relationship is dynamic, with each phase influencing the next. Understanding which best describes the nature of cause and effect in the context of the business cycle is crucial for companies to adapt and thrive. The interconnectedness of factors such as spending, investment, and employment shapes the trajectory of the cycle, emphasizing the importance of proactive strategies in managing the effects of economic shifts.